Every now and then, a company makes a move so smart you almost miss it because it feels obvious in hindsight. Sharon Goldman’s Fortune piece on Nvidia’s Q2 results had one of those moments. Buried in the discussion about mega-AI campuses (the kind that sprawl the size of Manhattan) was a single product reference: Spectrum-XGS.

At first glance, just another bit of networking kit. Look closer, though, and you find the real needle.

The Third Way to Scale AI

Until now, the playbook for scaling AI data centers had two paths:

-

Scale-up: cram more GPUs into a single rack.

-

Scale-out: build ever-larger facilities stuffed with racks.

But here’s the rub: power grids, financing, and local resistance are already capping how far those paths can go.

Spectrum-XGS creates a third option: link multiple smaller data centers together so they behave like one giant AI super-factory.

It’s the same trick researchers once used by wiring together hundreds of Sony PlayStations into a cheap supercomputer. Only this time, the scale is billions of dollars and industrial infrastructure. Nvidia has taken the student hack and weaponized it for the AI era.

Why This Is APPEALING TO INVESTORS

One useful nuance raised on LinkedIn in debating this article is that Spectrum-XGS isn’t a brand-new hardware breakthrough so much as a sophisticated upgrade of Nvidia’s existing Ethernet stack. What’s new is the framing: “AI superfactories” and “unified supercomputers.”

In other words, Nvidia has bundled protocols and infrastructure under a bold new narrative that investors can immediately grasp. Another sharp comment noted that the real bottlenecks for scaling aren’t chips anymore—they’re energy, cooling, and grid-level constraints.

The Financial Projection: What Could This Mean?

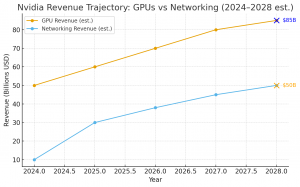

Here’s where it gets interesting for investors. Nvidia’s networking segment already grew 98% year-on-year in Q2 2025, hitting roughly $7.3 billion for the quarter. That puts it on track for nearly $30 billion annualized run-rate today.

Now fold in Spectrum-XGS and the coming silicon photonics networking gear (due 2026):

-

Analyst best-case models suggest networking could exceed $50 billion annually by 2028, making it a business on par with Nvidia’s GPU division at the start of the AI boom.

-

If margins stay close to today’s ~75% gross margin profile, that’s an extra $35–40 billion in annual gross profit within three years—entirely incremental to GPUs.

In other words, Spectrum-XGS doesn’t just hedge risk. It opens up a second growth engine that could rival Nvidia’s core GPU business in scale.

That said Nvidia’s clever hedge with Spectrum-XGS may cushion it from facility-level risks, but its fortunes will still rise and fall with whether the underlying infrastructure can keep pace.

The Needle in Plain Sight

The narrative everyone’s watching is: Will AI mega-campuses get built, or will they collapse under their own weight?

The needle is this: Nvidia wins either way.

Just as stringing PlayStations together once proved you didn’t need a Cray supercomputer to do world-class computing, Nvidia has shown you don’t need a single Manhattan-sized AI fortress to scale. You just need the right plumbing.

And now Nvidia owns that plumbing. That’s why, for investors, the long-term story looks even stronger than the headlines suggest.

This article was written using ChatGPT-5 with a custom-built Needle Framework designed to surface hidden insights, combined with my journalistic training and analytical intuition.